north dakota sales tax online

The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. Sales tax rates in north dakota.

North Dakota Tax Sales Tax Deeds Youtube

This free and secure.

. This allows you to file and pay both your federal and North Dakota income tax return. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view. North Dakota Taxpayer Access Point ND TAP is an online system taxpayers can use to submit electronic returns and payments to the Office of State Tax Commissioner.

Sales and use tax rates look up. North Dakota is a destination-based sales tax state. It is strongly recommended.

Free online 2017 Q3 US sales tax calculator for Erie North Dakota. The state of North Dakota levies a 5 state sales tax on the retail sale lease or rental of most goods and some services. North Dakota has recent rate changes Thu Jul 01.

The state sales tax rate in north dakota is 5000. North Dakota participates in the Internal Revenue Services FederalState Modernized E-File program. North Dakota State Sales Tax Online Registration Any business that sells goods or taxable services within the state of North Dakota to customers located in North Dakota is required to.

So no matter if you live and run your business in North Dakota or live outside North Dakota but have nexus there you would charge sales tax. Busineses with nexus in North Dakota are required to register with the North Dakota Department of Revenue and to charge collect and remit the appropriate tax. Exact tax amount may vary for different items.

Sales Tax Taxpayer Access Point TAP North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders. To find a specific form use the search boxes to enter the name of the form select the. The North Dakota ND state sales tax rate is currently 5.

With local taxes the total sales tax rate is between 5000 and 8500. Fast and easy 2017 Q3 sales tax tool for businesses and people from Erie North Dakota United States. Depending on local municipalities the total tax rate can be as high as 85.

North Dakota Tax Nexus. HOW TO GET A SELLERS PERMIT IN NORTH DAKOTA You can either fill out a paper application and file it in person or you can simply submit an online application. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to North Dakota local counties cities and special taxation.

Local jurisdictions impose additional sales taxes up. The state sales tax rate in North Dakota is 5000. The state general sales tax rate of north dakota is 5.

Manage your North Dakota business tax accounts with Taxpayer Access point TAP. North Dakota assesses local tax at the city and county. Additionally the state reduces the tax rate for business taxpayers purchasing new farm.

Seminar and a two-hour NDSD Border Construction Contractors Seminar are held twice a year once in. 2022 North Dakota state sales tax. Thursday June 23 2022 - 0900 am Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up.

The sales tax rate for North Dakota is 5 percent plus the applicable rate for local jurisdictions. Forms for North Dakota Tax Home Forms Forms Forms are listed below by tax type in the current tax year. Register for a South Dakota sales tax license using the online Tax License Application.

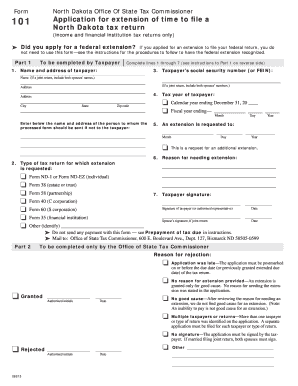

North Dakota Form 101 Fill Online Printable Fillable Blank Pdffiller

Welcome To The North Dakota Office Of State Tax Commissioner

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

How To Get A Certificate Of Resale In North Dakota Startingyourbusiness Com

News North Dakota Enacts Online Sales Tax As It Awaits Supreme Court Ruling Heartland Institute

Online Sellers Lament Lack Of State Sales Tax Uniformity

Economic Nexus And South Dakota V Wayfair Inc Avalara

Fillable Online Nd Application For Income Tax Withholding And Sales Use Tax Permit Application For Income Tax Withholding And Sales Use Tax Permit Fax Email Print Pdffiller

Where S My Refund North Dakota H R Block

Sales Use Tax South Dakota Department Of Revenue

Supreme Court Rules States Can Collect Sales Tax From Internet Retailers In Historic E Commerce Case Geekwire

Buying Online To Avoid Sales Tax And Not Paying Use Tax Congress May End That Soon

Internet Sales Tax Definition Types And Examples Article

Sfn 17147 Fill Out Sign Online Dochub

Sales Use Tax Changes Sales Tax Requirements Virginia Cpa Firm